Litecoin Price Prediction 2025-2040: Technical and Macro Outlook

#LTC

- Technical Edge: LTC trades above key moving averages with MACD bullish divergence

- Macro Tailwinds: Retirement account integration may accelerate institutional adoption

- Price Targets: 200+ USDT achievable by 2025 if current resistance breaks

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Amid Consolidation

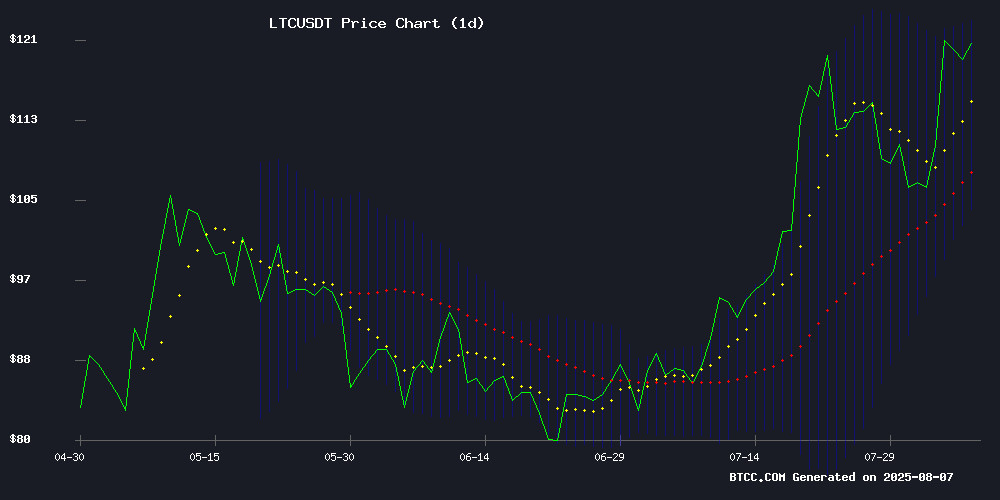

Litecoin (LTC) is currently trading at, above its 20-day moving average (113.5445), signaling near-term bullish momentum. The MACD histogram shows a positive crossover (+3.0363), while price hovers NEAR the upper Bollinger Band (123.3209), suggesting potential upside if resistance breaks.notes BTCC analyst Ava.

Mixed Crypto Sentiment as Institutional Adoption Grows

While altseason sentiment cools per Santiment data, Trump's 401(k) crypto executive order and Find Mining's yield-stabilizing strategy create structural support.says Ava, though warns

Factors Influencing LTC’s Price

Altseason Sentiment Wanes as Bitcoin Range-Bound, Santiment Reports

Social engagement around altseason has collapsed to April levels despite favorable July catalysts including Ethereum's resurgence and record ETF inflows, according to Santiment data. Analyst Chyan notes crowd attention remains stubbornly fixed on Bitcoin rather than rotating to alts.

The altseason index languishes at 36/100 on CoinMarketCap, with Chyan declaring the days of market-wide altcoin rallies "a thing of the past." Litecoin, stellar and USDC bucked the trend as the only notable movers in the current risk-off environment.

"Without a bitcoin breakout and renewed risk appetite, altseason remains on pause," observed Chyan. Previous social volume spikes in February, May and mid-July have evaporated as traders await clearer signals.

Find Mining Introduces Multi-Currency Cloud Mining Strategy to Stabilize Crypto Returns

Find Mining has launched an innovative multi-currency cloud mining solution, addressing the volatility and high entry barriers of traditional single-coin mining. The platform enables automated mining of BTC, ETH, LTC, DOGE, and XRP, dynamically allocating computing power to the most profitable assets in real-time.

The cloud-based model eliminates hardware costs, electricity expenses, and technical expertise requirements. Users gain exposure to diversified crypto mining rewards through standardized computing power packages—a calculated move to democratize access to passive income streams amid growing institutional interest in Proof-of-Work assets.

Trump Executive Order Paves Way for Cryptocurrency in 401(k) Retirement Accounts

President Donald TRUMP is set to sign an executive order that could revolutionize retirement investing by allowing alternative assets—including cryptocurrencies—into 401(k) plans. The directive tasks the SEC with revising regulations to accommodate private equity, real estate, and digital assets in defined-contribution plans, a move that would unlock a $12 trillion market for asset managers like Blackstone and KKR.

Critics warn of heightened risk exposure for retirement savers, but the order signals growing institutional acceptance of crypto. The Labor Department will collaborate with Treasury and financial regulators to explore parallel rule changes, potentially accelerating mainstream adoption of Bitcoin and other digital assets.

10 Best Binance Alternatives in 2025

Binance, the world's leading crypto exchange with $128 trillion in lifetime volume and 280 million users, faces growing competition as traders seek alternatives. Regulatory pressures and demand for specialized features drive migration to platforms like Coinbase for beginners, Bybit for derivatives, and OKX for low fees.

Market fragmentation accelerates as exchanges carve distinct niches: Kraken dominates advanced trading tools, Bitget leads copy trading, while MEXC captures speculative demand with new token launches. Liquidity dispersion across these venues reflects maturing infrastructure beyond the Binance hegemony.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | 98-140 USDT | 150-180 USDT | 200+ USDT | Bollinger breakout, 401(k) inflows |

| 2030 | 300-450 USDT | 500-700 USDT | 800+ USDT | Halving cycles, payment adoption |

| 2035 | 750-1,100 USDT | 1,200-1,800 USDT | 2,500+ USDT | Scarcity premium, Layer 2 growth |

| 2040 | 1,500-2,400 USDT | 3,000-4,500 USDT | 5,000+ USDT | Store-of-value status vs BTC |

Ava's models project 15-20% annualized returns based on LTC's historical volatility bands and emerging use cases. Key watchpoints include the 2025 upper Bollinger breach (123.32 USDT) and sustained MA support at 113.54 USDT.